By Kevin Haas

Rock River Current

Get our mobile app

ROCKFORD — Drew Erickson recalls seeing a home on the market for $132,000 this summer not far from where he works.

It was small, not much larger than a single room in a home he looked at this week, “and it was dilapidated,” he said.

“It sold for $5,000 above asking.”

Buyers willingness to spend — even on less-than-ideal properties — has been evident in a housing market that’s been pummeling price records for the better part of two years.

New data released Friday by the Northwest Illinois Alliance of Realtors shows yet another record high in home sale prices. Homes sold in Boone, Winnebago and Ogle counties in August went for an average $193,557. That’s about 9% higher than the same month a year ago, and it’s the fourth-straight month of record home sale prices in the Rockford market.

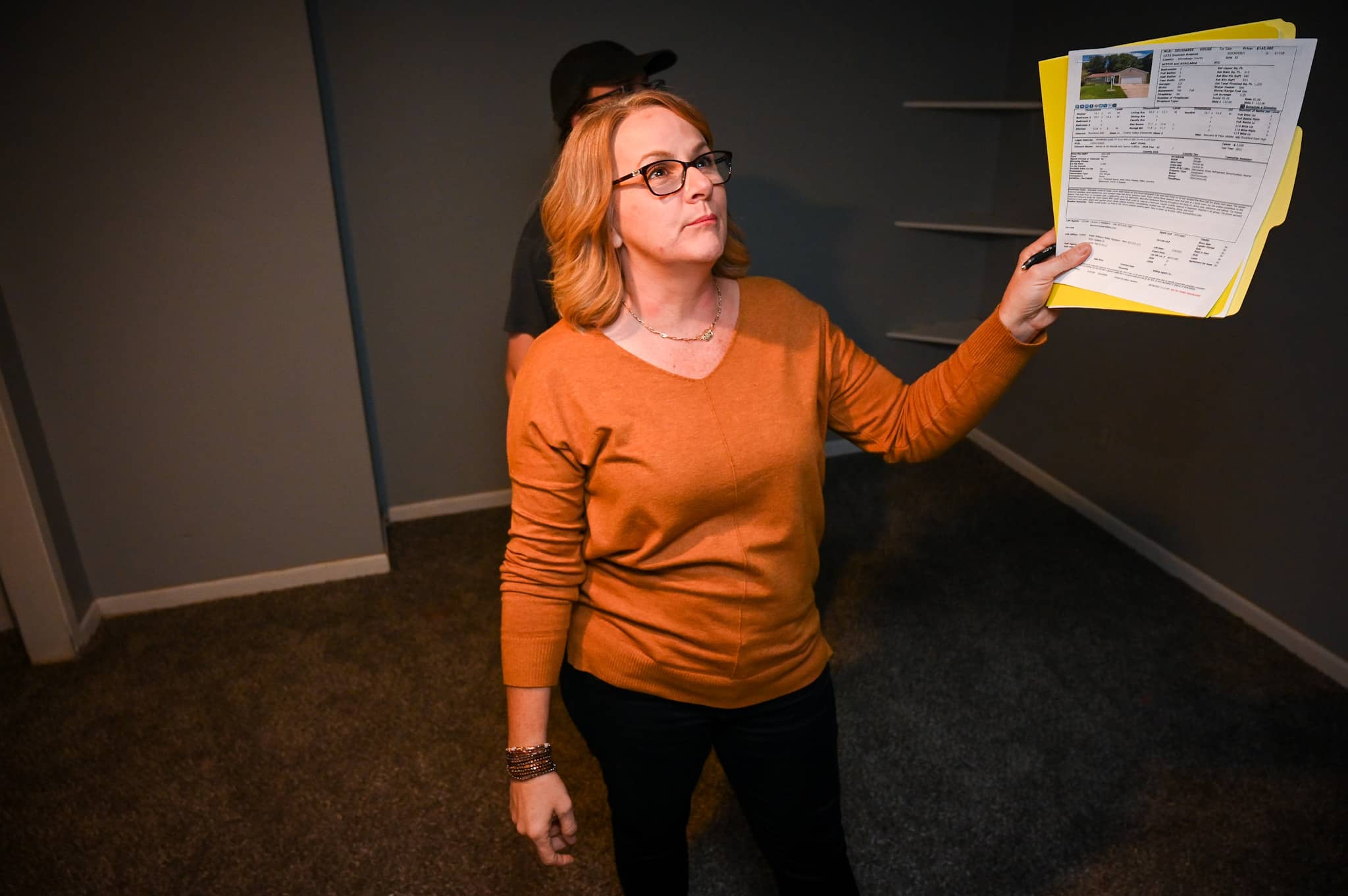

“The last couple of years things have been very good,” said Allison Hawkins, a Realtor with Keller Williams Realty. “Houses were selling right away, multiple offers, a lot of the buyers were paying 10-, 15-, $20,000 more than asking and still not getting the property.”

Related: Record Rockford-area home-sale prices have some buyers struggling to find an affordable place

That’s made house-hunting difficult for buyers like Erickson, whose been in the market for about six months and watched people scramble to snatch up properties just days after they hit the market.

Homes moved off the market in an average of 17 days in August. It was the fourth straight month the average was 17 days or fewer, including the record low of 10 days in July.

‘Buyers are starting to pull back’

But in the last month, as average mortgage rates have climbed by a percentage point, Hawkins has noticed a paradigm shift in the market. She doesn’t expect the record-setting streak of high prices to continue.

“What was happening in the spring and summer now has changed,” she said. “We’re noticing now that a lot of the buyers are starting to pull back.”

More news: Split Winnebago County Board decides against raising taxes for River Bluff

As that happens, sellers get nervous, too, she said.

“I’m starting to notice my sellers are getting more anxious now,” Hawkins said. “A lot of my sellers are getting more panicky. They’re wanting to reduce their prices a lot quicker. They feel like they have missed the boat.”

Mortgage rates have climbed as the Federal Reserve raised its benchmark interest rate. The central bank raised rates by 0.75 percentage points for the third time this year, and higher mortgage rates have followed. The 30-year fixed-rate mortgage averaged 5.22% in August and was up to 6.29% last week, according to Freddie Mac.

“That’s changing the buying power for a lot of my buyers,” Hawkins said.

A buyer that may have been qualified to purchase a $150,000 home, for example, may now only be qualified to buy at $135,000 because of the mortgage rate increase, she said.

Despite the rising rates, buyers like Erickson still see the benefit of the long-term investment, especially with rent prices increasing lockstep.

Realtors say his investment will pay off. Northwest Illinois Alliance of Realtors points to a new Homeowner Equity Insights study that shows the average U.S. homeowner saw their equity increase by 32% year over year in the first quarter of 2022. That amounts to an average $63,600 gain across the country, and $33,000 per homeowner in Illinois. Equity is the value of a home minus what a homeowner owes on the loan.

“Watching the stock market recently may have started to feel pretty challenging,” said Conor Brown, CEO of the Northwest Illinois Alliance of Realtors, “but checking the value of your home should come as welcome relief in this volatile time.”

Stocks continued their selloff this week, and on Thursday the S&P 500 closed at a new low for the year. But Brown said homebuyers are still making a good investment.

“If you’re a homeowner, your net worth most likely got a big boost over the past few years thanks to rising home prices,” Brown said. “That increase in your wealth came in the form of home equity.”

More news: ‘Make this dream a reality’: Hard Rock goes from when will you start to when will you finish

Buyers also continued to be frustrated by a lack of inventory of homes on the market, a problem that has driven up prices the past two years.

The number of homes for sale was 455 in August compared to 480 a year ago, a decline of 5%. That marked the 20th-straight month of fewer homes on the market. Turn back the clock three years and inventory sat at 1,198 homes, about 2.5 times higher than today.

Home sales across the market totaled 460 last month, a decline of 12% from 523 a year ago. However, it was the highest monthly total in the Rockford market this year.

Hawkins said the quality of homes still on the market isn’t as high as it was a few years ago, but what’s in good condition still moves quickly.

“If you’ve got a nice home, price it right and you’re still going to be able to sell it,” she said.

This article is by Kevin Haas. Email him at khaas@rockrivercurrent.com or follow him on Twitter at @KevinMHaas or Instagram @thekevinhaas.